NEWYou can now listen to Fox News articles!

MINNEAPOLIS, Minn. – The massive and sprawling $1 billion welfare-fraud schemes engulfing Minnesota are now casting fresh scrutiny on an old, opaque money-transfer network used by Somali Americans to send remittances back to their loved ones and friends — a system U.S. officials have warned can be siphoned or taxed by the terrorist group al-Shabaab.

Known as hawala, the centuries-old system moves money without banks, wiring infrastructure or standard documentation, yet it remains a lifeline for families in Somalia, where a national banking system barely exists. The system works by having a sender give money to an agent in the United States, who then instructs a partner in Somalia to pay the recipient directly, with no money ever physically crossing borders.

Hawala functions as an alternative remittance system, relying on trusted agents rather than banks. It is fast, inexpensive and reaches remote regions of Somalia where no formal banking system exists. For many Somali Minnesotans, hawala-linked payouts are the only practical way to support relatives overseas.

MINNESOTA LAWMAKERS VOW NEW CRACKDOWN AFTER $1B FRAUD MELTDOWN THEY SAY WALZ LET SPIRAL

A file image shows al-Shabaab militants in Somalia (left), alongside a woman counting Somaliland shilling notes at a currency exchange stall in Hargeisa on Nov. 8, 2024 (right). Somalia’s limited banking system means many families depend on informal money-transfer networks such as hawala — channels experts say can be vulnerable to taxation or exploitation in areas controlled by al-Shabaab. (Abdurashid Abdulle/AFP via Getty Images; Luis Tato/AFP via Getty Images.)

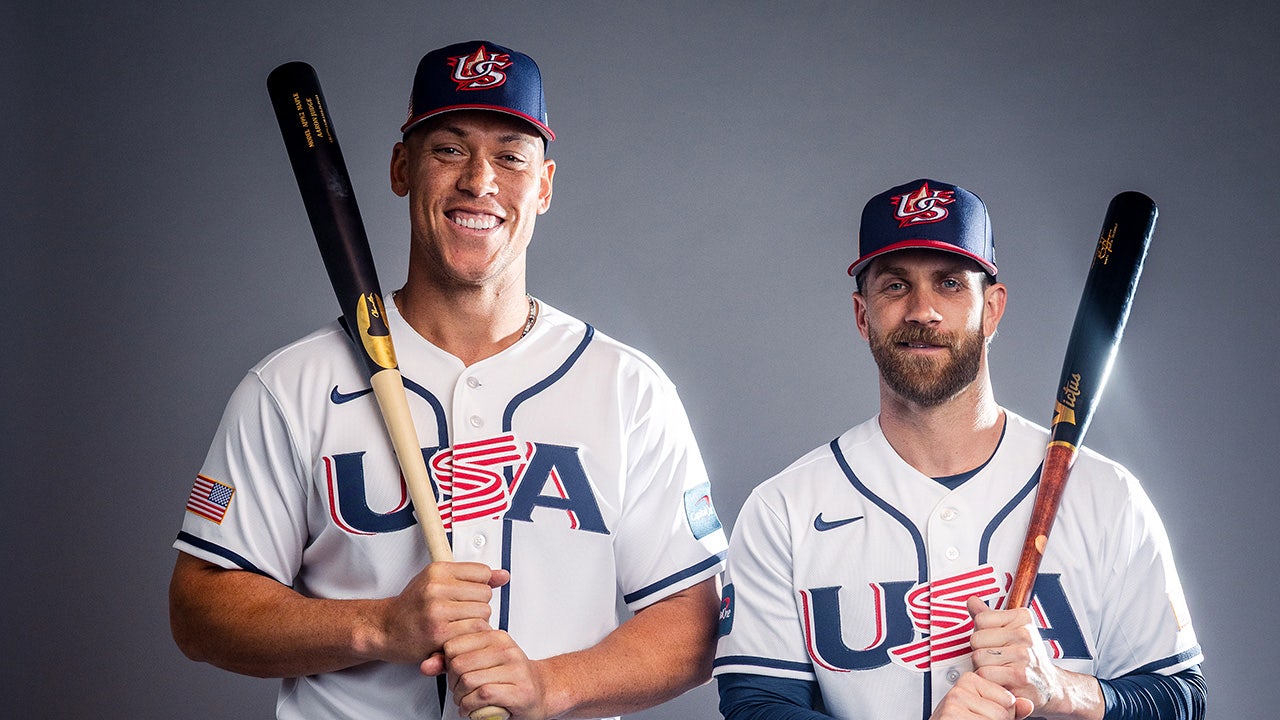

But U.S. officials are sounding the alarm on the system, with Treasury Secretary Scott Bessent announcing last month that the Treasury Department has opened a formal investigation into whether Minnesota taxpayer dollars doled out in the various schemes were diverted into financial channels that may benefit al-Shabaab which imposes taxes, extorts businesses or controls trade routes.

The House Oversight Committee has also launched its own inquiry into the fraud and the potential terror-finance risks, while Minnesota State Sen. Jordan Rasmusson said the concern is serious.

"Because there’s more than a billion dollars that’s been stolen and a significant portion of those dollars have been directed overseas, there are concerns this money could be either directly or indirectly funding terrorist organizations like al-Shabaab," Rasmusson told Fox News Digital.

Amal Money Wire in Minneapolis handles legal U.S. remittances for customers sending funds abroad. The business has not been accused of any wrongdoing and is not a hawala operator. (Michael Dorgan/Fox News Digital)

Remittances are essential for survival in Somalia, where millions rely on money from relatives abroad to meet basic needs in a country where corruption and extremist taxation shape everyday economic life.

Each year, according to the global poverty-fighting organization Oxfam, Somalis living in the United States send about $215 million home each year. Globally, the Somali diaspora sends approximately $1.3 billion, equivalent to 15 to 20 percent of Somalia’s total economic output, according to recent World Bank estimates.

Jaylani Hussein, executive director of the Council on American-Islamic Relations, Minnesota chapter (CAIR-MN), told Fox News Digital previously that for many Somali Minnesotans, these payments are part of their monthly budgets.

"Most families like my family, we still send between 10 to 15, or even 30 percent of our income to loved ones back home," he said.

‘HE HAD YEARS TO STOP THIS’: GOP LAWMAKERS BLAST WALZ OVER MASSIVE MINNESOTA FRAUD SCHEME

Somali Americans are among the poorest demographics in the United States, yet many face intense pressure to send large parts of their income abroad, even while struggling themselves. The result is a community financially stretched at both ends with hundreds of millions of dollars flowing through a system that becomes vulnerable once funds reach Somalia.

The warnings revive long-standing fears in Minnesota, where roughly 20 young Somali Americans left in the late 2000s to join al-Shabaab — including Shirwa Ahmed, who became the first known American Islamist suicide bomber in 2008. Last year, Abdisatar Ahmed Hassan, 23, pleaded guilty to attempting to provide material support to ISIS after twice trying to travel to Somalia.

A remittance storefront in Minneapolis’ Cedar–Riverside neighborhood. Businesses like this are licensed money-service providers and are not alleged to be involved in any illegal activity. (Michael Dorgan/Fox News Digital)

In Minneapolis' Cedar-Riverside neighborhood, known as "Little Mogadishu" due to its dense Somali population, Fox News Digital observed at least three wire-transfer storefronts in the area on Wednesday, while the only brick-and-mortar bank was an Associated Bank branch. Inside the wire-transfer storefronts, workers declined to speak on the record.

Those money wire stores operate legally in the United States and are licensed money-service providers. They have never been accused of wrongdoing and are not hawala shops and their role is to initiate the U.S. side of the transfer. They function similarly to Western Union counters, collecting cash from customers and sending the transaction data overseas.

The hawala system typically begins only after the money reaches Somalia, where limited banking options mean local agents pay out remittances from their own cash reserves and settle accounts privately. Experts say this Somalia-side leg of the process is where transfers often shift into hawala networks, becoming vulnerable to corruption or extremist taxation in regions controlled by al-Shabaab.

Anna Mahjar-Barducci, a Middle East analyst with the Middle East Media Research Institute (MEMRI), explained why hawala dominates Somalia’s economy.

"Hawala reaches places Western Union cannot. Much of Somalia, especially rural areas, has no formal banks or Western Union locations, but hawala agents exist almost everywhere," she told Fox News Digital.

NUTRITION PROGRAM’S LAWSUIT TRIGGERS MN EDUCATION DEPT TO EASE OVERSIGHT, OPENING DOOR TO MORE FRAUD

In practical terms, she said, money never crosses borders. A hawaladar in the sending country collects the funds and a counterpart in Somalia immediately pays out the equivalent amount from their own cash reserves, she said.

A Ramad Pay sign hangs above a licensed money-transfer business in Minneapolis. These companies legally process U.S. remittances and are not involved in hawala activity inside the United States. (Michael Dorgan/Fox News Digital)

Behind the scenes, operators later settle debts privately through offsetting transactions, trade arrangements or bulk cash shipments — mechanisms regulators cannot monitor, she said.

Mahjar-Barducci said al-Shabaab’s taxation system is concentrated in south-central Somalia, where the group maintains control or co-governance over rural districts, key transport routes and local markets. Its influence is far weaker in northern Somalia and is largely absent in the autonomous regions of Somaliland and Puntland, with only a limited presence in pockets on the outskirts of major cities like Mogadishu.

However, she noted that even mobile-money systems are vulnerable and that al-Shabaab can compel local shopkeepers to pay a monthly "license" fee and a percentage of every transaction they process.

CLICK HERE TO DOWNLOAD THE FOX NEWS APP

The Taaj Money Transfer storefront in Minneapolis’ "Little Mogadishu" neighborhood. The business is a licensed U.S. money-service provider and is not accused of any wrongdoing; it handles legal remittances before funds are transferred overseas for final delivery. (Michael Dorgan/Fox News Digital)

"In general, in Somalia, corruption affects daily life. Many people need connections or small payments to get services or jobs," she said.

"The diaspora sender typically is unaware of the exact tax," she added, noting that even legitimate remittances can lose value through hidden fees, coercion or extremist-controlled toll points.

When it comes to Minnesota’s fraud, she said the risk is real.

"In theory, once money from fraud is converted into cash, it can move through the same informal channels as ordinary remittances, like hawala."

Michael Dorgan is a writer for Fox News Digital and Fox Business.

You can send tips to [email protected] and follow him on Twitter @M_Dorgan.