Join Fox News for access to this content

Plus special access to select articles and other premium content with your account - free of charge.

By entering your email and pushing continue, you are agreeing to Fox News' Terms of Use and Privacy Policy, which includes our Notice of Financial Incentive.

Please enter a valid email address.

Victims of car collisions may have more to worry about as insurance companies warn drivers to be aware of a growing scam involving tow truck companies.

Chris Stroisch, the National Insurance Crime Bureau (NICB) vice president of public affairs & communications, shared with Fox News Digital that they are seeing a "significant spike in predatory tolling in the United States, which has increased 89% in the last three years."

"We're seeing predatory towing occurring in cities both large and small. So you're seeing predatory towing occurring in large cities like Chicago, Los Angeles, and Washington, D.C. But you're also seeing it in small communities like Des Moines, Iowa," Stroisch said.

Stroisch explained that these predatory towers are "following the money" and will operate wherever they can make the most profit.

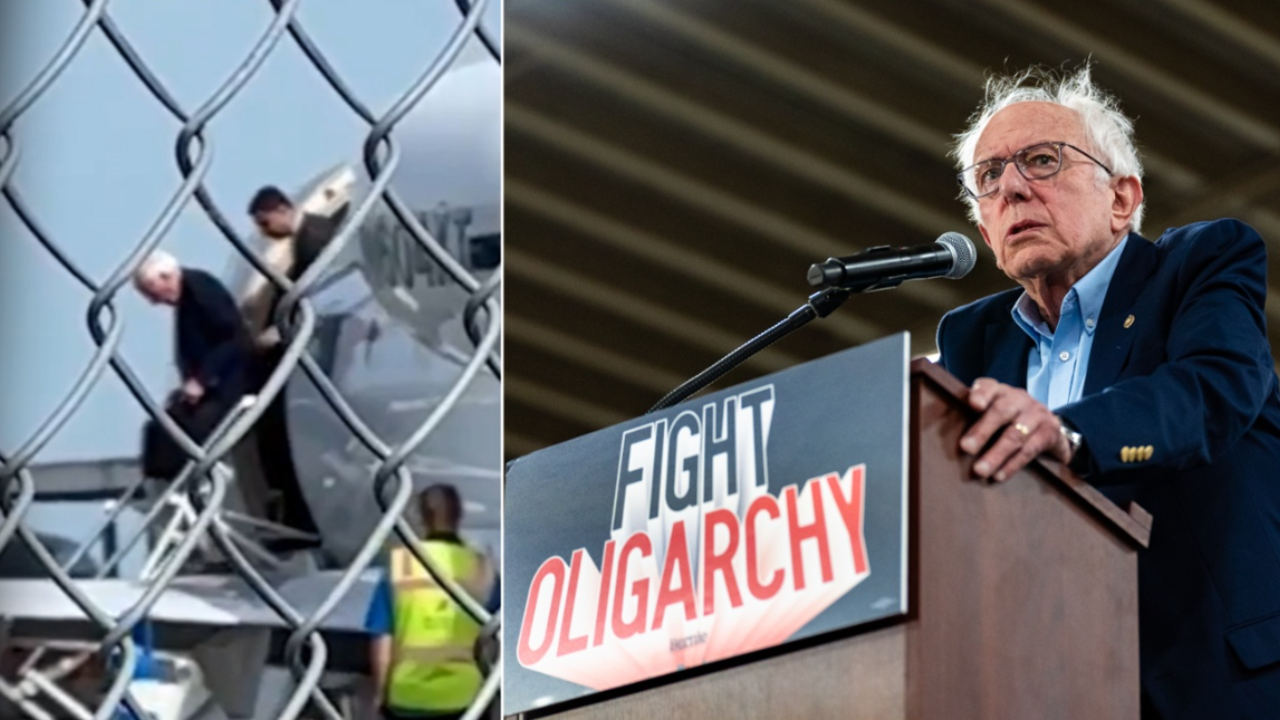

A tow truck brings a car to a repair shop. (Getty Images)

"Unfortunately, what we're seeing on our end is that we're hearing a lot of sad stories," Stroisch said. "Predatory towers that are engaging in reckless driving, they're engaging in turf wars even, and there's even been shootings tied to predatory towing that's all leading to very tragic, but avoidable deaths. So it's really just this growing problem that we've seen take off in the last three years in this country."

The California Department of Insurance echoed the NICB warning and added that it has seen an uptick happening where some tow truck companies are targeting drivers involved in crashes by picking up their cars and then holding them hostage for large amounts of money.

"This type of scam is preying on drivers at their most vulnerable moments—immediately after an accident—when they should be focused on their safety and next steps, not fighting to get their vehicle back," Insurance Commissioner Ricardo Lara said in a statement. "Our department is committed to protecting Californians from fraud, and this PSA is an important step in ensuring drivers know the warning signs and how to protect themselves."

A spokesperson for the agency told Fox News Digital that, right now, they are seeing two primary scams. One involves a tow truck driver showing up immediately after a collision occurs and offering to help the other driver by towing their vehicle to a body shop.

"Tow drivers show up to accident scenes and misrepresent to the crash victim that they were sent there by the insurance company, when they were in fact not," the agency said. "The suspects steal/tow the victim’s vehicle under false pretenses to a body shop or tow yard. They then charge exorbitant fees to the victim or insurance company to release the vehicle."

FBI WARNS OF DANGEROUS NEW ‘SMISHING' SCAM TARGETING YOUR PHONE

California officials said one common scam involves a tow truck driver showing up immediately after a collision occurs and offering to help the other driver by towing their vehicle to a body shop. (Getty Images)

The second scam the agency said they are seeing is when a tow driver steals personal information from the victim by posing as law enforcement or an insurance company employee.

"Suspects contact the crash victim claiming to be an employee of the victim’s insurance carrier, indicating they will tow the vehicle to a body shop approved by their insurance company and then steal/tow the vehicle under false pretenses," the California Department of Insurance spokesperson said.

Stroisch added that there are two rules of thumb that they tell consumers.

"First thing, if you didn't request it, reject it," Stroisch said. "If you're in an accident and a tow truck company shows up on scene that's unsolicited, we tell people to wait for law enforcement to arrive. And then once that tow truck company is on scene, to know as much as you can or know before you tow."

The California Department of Insurance shared a few red flags drivers should be aware of to make sure they are not a victim of this type of scam, which include:

- If a tow truck shows up within minutes of an accident before you have had time to call anyone yet.

- If a tow truck driver tells you which body shop your car is going to instead of working with you to identify where you want your vehicle to go.

- If a tow truck driver tells you that someone will contact you by phone or asks you to sign documents.

- If a tow truck driver requests a rideshare for you.

In response to the growing scam trend, the agency said that it has created three law enforcement task forces in Southern California that investigate organized automobile insurance fraud.

The task forces are comprised of CDI detectives, investigators from the California Highway Patrol, and investigators from the local district attorney’s offices, the agency explained, adding that it manages these task forces.

"These task forces work up these crimes, present the case to the district attorney’s offices for filing criminal charges, and arrest the suspects. Additionally, we work with other state agencies, such as the Bureau of Automotive Repair, to refer cases for administrative sanctions," the agency said.

"We also spend considerable time educating our state and local law enforcement partners to assist us in better recognizing this type of activity, and we have been releasing public service announcements to raise the public’s awareness."

The California Highway Patrol is part of the state's effort to investigate car insurance fraud. (CHP El Cajon)

According to the department, the Inland Empire Automobile Insurance Fraud Task Force has investigated multiple cases, including one that has resulted in the arraignment and charges against 16 Southern California residents.

"This task force investigation found the auto fraud ring allegedly conspired together to create fraudulent insurance claims to illegally collect over $216,932," the department said in a statement. "The investigation discovered the large-scale organized auto insurance fraud ring was engaged in multiple types of schemes including holding vehicles hostage and collusive collisions."

This same ring, the department shared, was previously charged in a similar scheme stemming from vehicles stolen under false pretenses in San Bernardino County.

Stroisch shared that some of these operators are even charging upwards of 10 times the usual cost of a tow, and then are holding the vehicles hostage in the process.

"The average cost of a tow is $109, but we're seeing costs that have skyrocketed, and we're seeing costs that are 10, 15, 16, and $17,000 that are just filled with absorbent fees and very vague descriptions of what people are actually paying for all while these vehicles are being held hostage," Stroisch explained.

Officials said while most towing companies are reputable, there is a warning on unlicensed predatory tow truck companies that prey on drivers when they are most vulnerable. (Getty Images)

HOW SCAMMERS HAVE SUNK TO A NEW LOW WITH AN AI OBITUARY SCAM TARGETING THE GRIEVING

"If you're in an accident, get as much information as you can about a tow truck company and wait for law enforcement to arrive first."

While tow truck scams are nothing new, the California Department of Insurance said they are on the rise, increasing by over 1,500 reports since 2023.

"We do not have stats specific to this type of scam, but in 2024, CDI received 13,870 referrals of suspected automobile insurance fraud from insurance companies, government agencies and the public, which increased from 2023, where we received 12,363," the department shared.

The department said it is urging any drivers that believe they may be in a situation like this to verify the tow truck with their insurance company or wait for CHP to verify the tow truck was dispatched by CHP, adding to also not sign any documents until you have talked to their insurance company.

CLICK HERE TO GET THE FOX NEWS APP

Stroisch said one of the biggest things that the bureau is seeing right now is the lack of laws and the lack of policies in some cities and states.

"Every state, every municipality is different, and some states have laws against predatory towing. They have laws that require licensing of tow truck companies. They have laws that require transparency around fee schedules, but there are many cities and states that don't," Stroisch explained. "So I think that from an NICB standpoint, we would recommend all lawmakers at every level, work together to put measures in place to help prevent this."

Stroisch suggested that banning accident scene solicitations is one example of how predatory towing can be thwarted.

"That's where a lot of this is occurring. These tow truck companies that just show up on scene, so ban accident scene solicitation in the first place. So we are really encouraging lawmakers to work together to pass legislation.

"We are currently monitoring 107 different bills in 37 states that are all tied to predatory towing. So to have that many bills that are in some stage, it's just showing the problem that we're seeing right now."

Stepheny Price is a writer for Fox News Digital and Fox Business. She covers topics including missing persons, homicides, national crime cases, illegal immigration, and more. Story tips and ideas can be sent to [email protected]