NEWYou can now listen to Fox News articles!

In Washington, facts are often the first casualty of politics. Nowhere is that more apparent than in the debate over the Tax Cuts and Jobs Act (TCJA) of 2017 — President Donald Trump’s signature tax reform law from his first term in office. As debates rage whether to extend the TCJA’s individual tax cuts, left-wing politicians and legacy media outlets are ramping up their usual misinformation campaign.

We’ve all heard the talking points: The TCJA was a "wealth transfer" that came "at the expense of working families," a "giveaway to billionaires," or my personal favorite, a "reverse Robin Hood" scheme to rob the working class for the benefit of the ultra-wealthy.

There’s just one problem: none of that is true. Not even close.

TAX TIPS: LAST-MINUTE ADVICE FROM EXPERTS AS TAX DAY NEARS

Earlier in April, I co-authored a new policy study for The Heartland Institute examining the latest IRS personal income tax data. Our goal was to determine if the Republican tax law is still saving taxpayers money, and if so, how much?

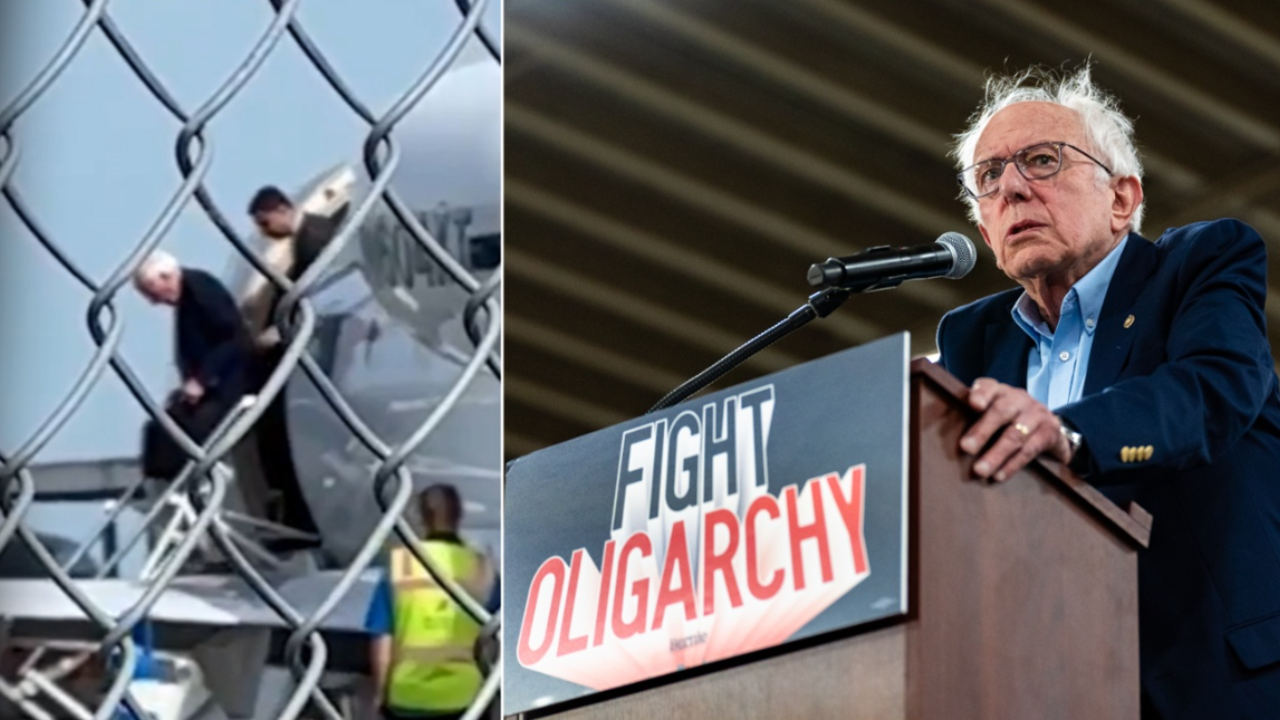

Trump can point to the success of his tax-cut strategy in aiding the middle class, according to a new study.

What we found is that lower- and middle-income Americans have received the largest tax breaks due to the TCJA — and these are not small amounts, either. We estimate tens of millions of filers have saved thousands of dollars because of the Republicans’ tax reform law, savings that are now at risk should Congress fail to extend the cuts before they expire at the end of 2025.

The evidence is clear, compelling and impossible to ignore — unless you’re a partisan activist masquerading as a journalist.

Massive tax relief for the middle class

Using government data, we were able to calculate how much in taxes the average filer in each IRS income bracket paid annually from 2017 to 2022. TCJA was passed into law in 2017 but didn’t go into effect until 2018. By comparing the data from 2017 to later years, we can determine the effect of the tax cuts on individuals and families.

The IRS data shows that every income bracket received a tax cut because of the TCJA, but the taxpayers who received the biggest cuts, in terms of percentage saved, went to those who earned less than $75,000.

For example, the average filer in the IRS’s "$40,000 under $50,000" bracket paid 18.8% less in taxes in 2022 than they did in 2017.

Similarly, the tax bill for filers in the "$50,000 under $75,000" bracket was 16.5% less in 2022 than it was in 2017.

For comparison, those earning between $5 million and $10 million paid 2.3% less over the same period. So much for the "billionaire tax cut" narrative. (You can find data for other income brackets in our published paper, which is available here.)

Some critics of the TCJA have claimed that although middle-income Americans received large cuts to their tax rates, those tax rate reductions didn’t amount to significant savings in terms of total dollars. But these assertions are also false. Many middle-class Americans have saved thousands because of the TCJA.

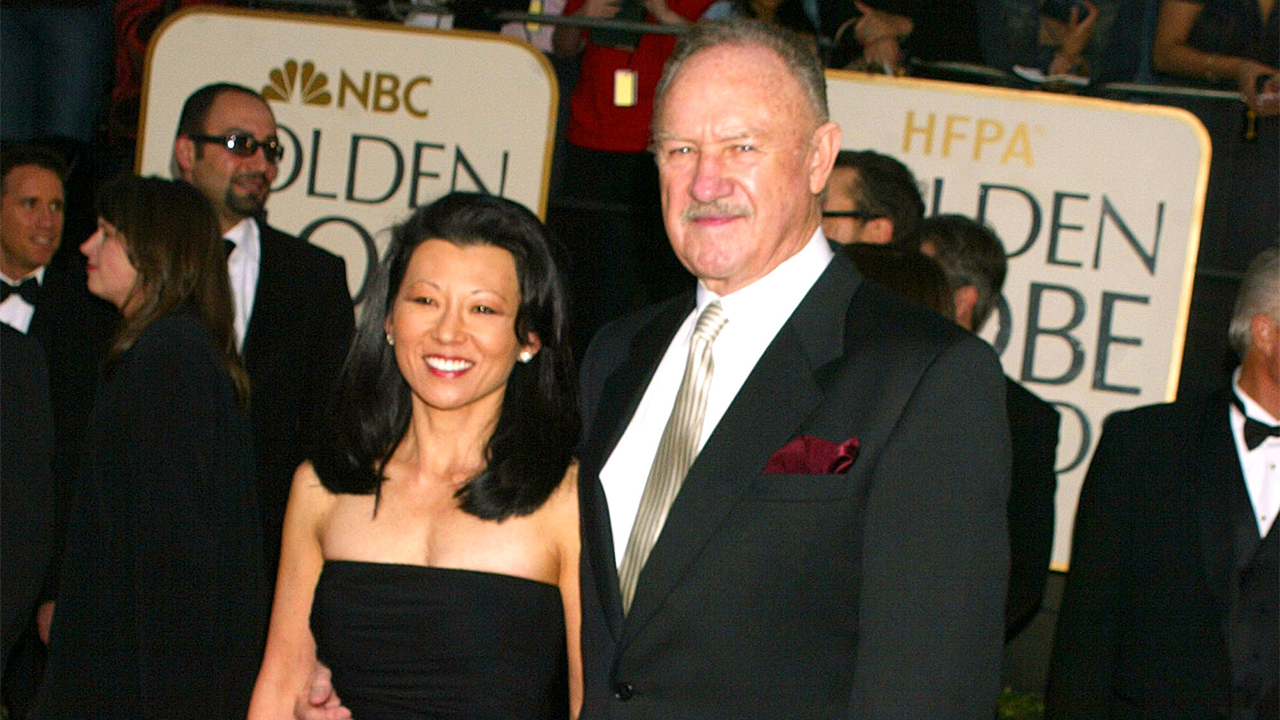

A new analysis of IRS tax data indicates that everyone benefited from the Trump tax cuts, but those who earned less than $75,000 received a much-higher percentage of savings. (Samuel Corum/Bloomberg via Getty Images)

Our analysis found from 2018 to 2022, filers earning between $50,000 and $75,000 annually saved an average of $4,516 because of the personal tax cuts contained in the TCJA. For those in the $75,000 to $100,000 bracket, the savings jumped to $5,923. And those earning $100,000 to $200,000 saved an astonishing $9,638 over five years.

These numbers do not tell the full story, however. Because the most recent IRS data available is from 2022, total savings estimates do not include the numbers from 2023 and 2024. To account for these years, we developed projected figures using the average amounts saved in 2018 to 2022.

After extending the analysis through 2024 using consistent annual trends, the numbers become even more impressive. In 2022, more than 50 million middle-class filers fell into brackets that saved on average between $6,322 and $13,494 in total savings.

Even lower-income and working-class Americans saw substantial relief. We estimate that households making between $30,000 and $50,000 saved $2,537 to $3,833 over the same period.

A more progressive tax code

Ironically, the very law Democrats call a boon for the rich has made the U.S. tax code more progressive. We came to this conclusion by examining the tax burden paid by each IRS income bracket in 2017, the year before TCJA went into effect, compared to their burdens in subsequent years.

What we found is that in 2022, the most recent year for which data is available, every income bracket earning less than $200,000 paid a smaller share of the total personal income tax burden than they did in 2017. Conversely, every bracket above $200,000 paid a greater share.

CLICK HERE FOR MORE FOX NEWS OPINION

That means that although every income group received a tax cut because of the TCJA, the Trump tax cuts caused wealthier filers to pay for a bigger chunk of the personal tax revenue pie than they did in previous years, the exact opposite of what Democrats frequently claim.

The clock is ticking

If Congress does nothing, the TCJA’s personal income tax cuts will expire at the end of 2025. That means tens of millions of Americans will face a stealth tax hike. For many middle-income families, it could mean paying $900 or more in taxes annually.

After extending the analysis through 2024 using consistent annual trends, the numbers become even more impressive.

Washington elites might not feel it, but working families sure will.

CLICK HERE TO GET THE FOX NEWS APP

That’s why this fight matters. This isn’t about President Donald Trump or partisan point-scoring — it’s about whether the government should take more from families already struggling under the weight of inflation and stagnant wages.

The data is in. The verdict is clear. The Tax Cuts and Jobs Act worked — for everyone, but especially for working-class and middle-income Americans. It’s time to tell the truth about the tax cuts, and then make them permanent.

CLICK HERE TO READ MORE FROM JUSTIN HASKINS

Justin Haskins is a New York Times bestselling author, senior fellow at The Heartland Institute, and the president of the Henry Dearborn Liberty Network.